I. Changes in tire companies participating in the ranking

In 2021, a total of 52 domestic and foreign tire companies participated in the ranking activity. In 2020, there were 54 tire companies participating in the ranking, 53 in 2019, 60 in 2018, and 57 in 2017, and 54 in 2016.

This year, 3 "new faces" are ranked: KONE Tire Co., Ltd., Shandong Linghang Tire Co., Ltd., and Zhengdao Tire Co., Ltd. Among them, KONE Tire did not participate in the ranking last year for some reason, and will participate again this year; the other two are new faces on the list.

There are 5 companies that dropped out of the ranking this year: Ningxia Shenzhou Tire Co., Ltd., Shandong Fengyuan Tire Manufacturing Co., Ltd., Shandong Chuanghua Tire Co., Ltd., Qingdao Aonuo Tire Co., Ltd., Shandong Haoke International Rubber Industry Co., Ltd. There are operating reasons for the exiting enterprises, as well as reasons for mergers and acquisitions.

Among them, Shandong Linghang Tire is a new company established after the reorganization of four enterprises, Xintu (Ogrey), Xinhaoke, Shengtai and Shengshi Tailai. Its parent company, Wuchan Zhongda Group Co., Ltd., has attracted the attention of the tire industry in recent years. It is a super large state-owned holding enterprise group in Zhejiang Province and has been shortlisted in the Fortune Global 500 for 9 consecutive years. The main business includes supply chain integration services (mainly trade), manufacturing (industry), finance (trading platform, futures, factoring, leasing). Its subsidiary, Wuchan Zhongda Chemical Group Co., Ltd., has been involved in the supply chain business of the tire industry since 2017. It is very active in the custody operation, joint venture, and restructuring of the tire industry. Last year, it acquired Xintu and Xinhaoke. This year it acquired Shengtai and Shengshi Tailai, established Shandong Linghang Tire, and officially became a member of the tire industry family.

Zhengdao Tire is an independent company from Shandong Haohua Tire in 2020. This year, it participated in the tire ranking with a new face.

II. Changes in the ranking of Chinese tire companies

Taking the top 25 companies as an example, compared with 2020, the changes in the ranking of Chinese tire companies in 2021 are shown in Table 1.

(1)Changes

As can be seen from Table 1, among the top 10 companies in 2021, the top three remain unchanged, and they are still Zhongce Rubber, Linglong Tire, and Sailun Group; Triangle Tire rose from No.6 to No.4; Double Coin Tire rose from No. 7 to No. 5; Xiamen Zhengxin fell from No. 5 to No. 6; Qingdao Shuangxing rose from No. 9 to No. 7; Guizhou Tire rose from No. 10 to No. 8; Pu Lin Chengshan and Fengshen tires rose from the 12th and 11th places in the previous year to the 9th and 10th places. Shandong Haohua and Shandong Changfeng dropped from 4th and 8th last year to 11th and 12th this year.

Among them, the sales revenue of Linglong, Triangle, Shuangqian, Double Star, Prinx Chengshan, Sichuan Haid, Tianjin Wanda, Shouguang Fumax, Dongying Fangxing, Weifang Yuelong, and Weifang Shunfuchang increased significantly.

(2)Reason for change

The reasons for these changes can be attributed to mergers and reorganizations, overseas factories, and market driving.

Double Coin Tire's overseas factories have been in the process of releasing production capacity in the past two years. In 2020, the sales revenue of the Thai factories increased by 59.47% year-on-year (the same below), an increase of 537 million yuan; the domestic factory completed the integration, and the sales revenue also increased by 5.69%.

In 2020, Prinx Chengshan Thailand factory initially formed production capacity and achieved sales revenue of 330 million yuan; at the same time, domestic factory sales revenue increased by 7.4%, so its total domestic and foreign sales revenue increased by 13.36% .

Shandong Haohua's ranking last year included Zhengdao Tire. This year, Zhengdao Tire participated in the ranking alone, so its sales revenue this year dropped by 48.4%.

After the second quarter of 2020, the tire market has gradually improved. First, because China has basically controlled the epidemic, domestic production in various industries has been restored, especially the output of commercial vehicles has increased by 20%; second, the spread of the epidemic abroad has affected the production of foreign tire companies, so there is room for China's tire exports. Therefore, the output and sales revenue of most tire companies have increased to varying degrees.

At the same time, since last year, tire companies have accelerated their capacity expansion. Not only well-known tire companies at home and abroad, but also a group of state-owned and private enterprises that have newly entered the tire circle have invested in tire projects. The investment projects of large tire companies are basically high-end, green and intelligent tire projects, but there are also some investments that obviously tend to be homogenized. Here, tire companies are reminded to pay close attention.

In addition to all-steel tires, semi-steel tires and engineering tires, self-healing tires, agricultural radial tires, and aviation tires are also hotspots for investment projects.

2. 2021 Chinese Domestic Tire Enterprise Ranking

Taking the top 25 companies as an example, compared with 2020, the changes in the ranking of tire companies in China in 2021 are shown in Table 2.

Table 2 is based on the tire sales revenue of all tire companies (including foreign-funded companies) in mainland China in 2020, so the ranking can better reflect the tire market in mainland China in 2020.

It can be seen from Table 2 that among the top 25 tire companies, 16 companies have an increase in sales revenue, 7 companies have a decline, and 2 companies have no comparative data.

3. New projects in the past two years

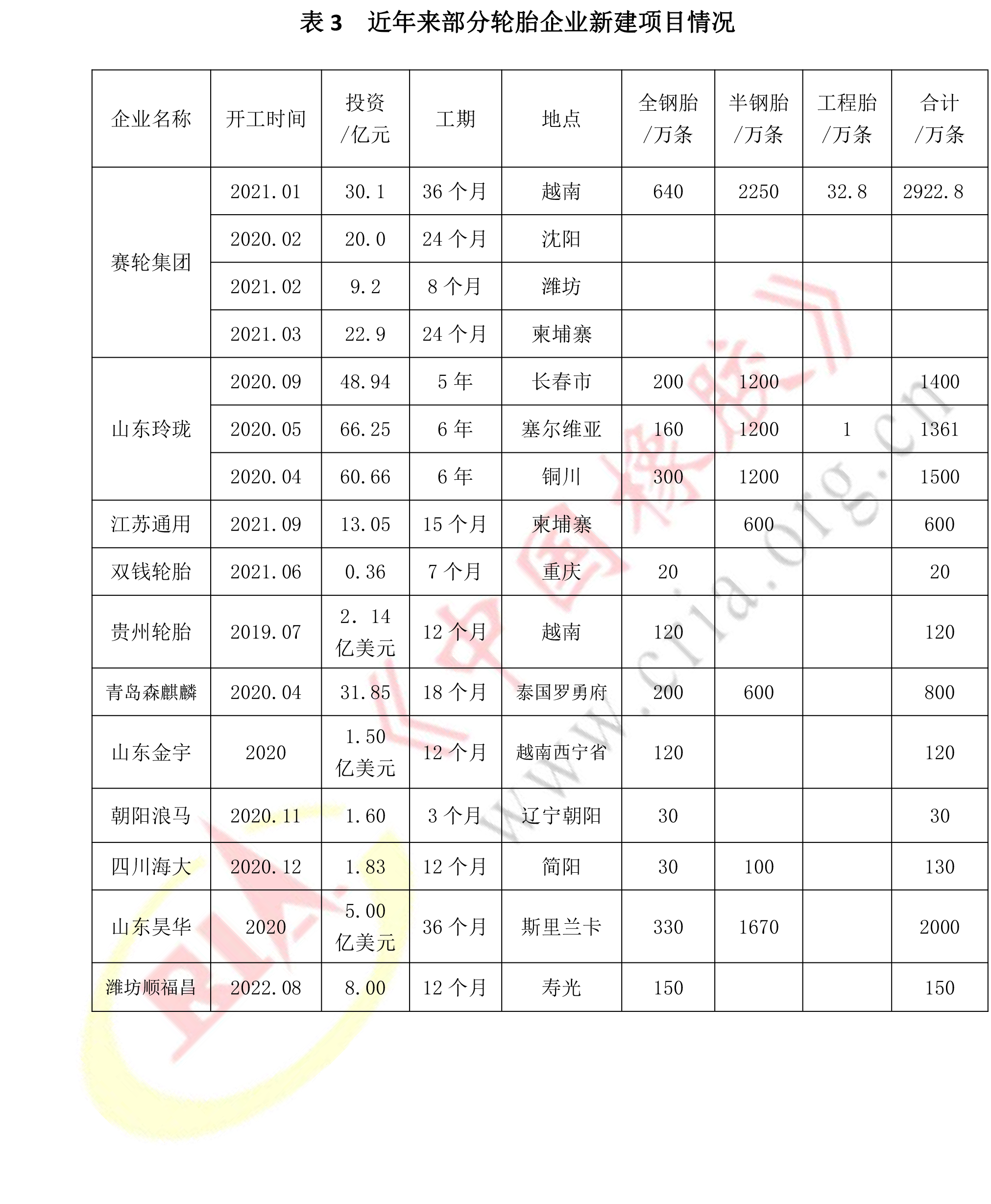

The new projects of some tire companies from 2018 to 2020 are shown in Table 3.

According to the public reports of the media in the past two years, here is a list of the newly increased production capacity of some key enterprises participating in the tire ranking.

(1)Jiangsu GM

On December 27, 2019, the first tire of Jiangsu GM's annual production of 1.2 million high-performance intelligent all-steel tires rolled off the production line; on December 28, the first tire of its production base in Thailand rolled off the production line. The total investment of the project is US$300 million, with an annual production capacity of 6 million semi-steel tires and 1 million all-steel tires, with sales revenue of 488 million yuan in 2020.

On June 2, 2021, Jiangsu GM announced that it will build a second overseas factory in Cambodia, and launch a project with an annual output of 6 million high-performance semi-steel radial tires.

On July 1, 2021, Jiangsu General Motors invested 3 billion yuan and the annual output of 10.2 million high-performance radial tires was signed in Anqing Economic Development Zone, Anhui.

(2)Linglong tires

On December 11, 2019, Linglong Tire's fourth domestic factory in Jingmen, Hubei, put into production truck and bus tires; on January 11, 2020, passenger car tires were put into production. The total investment of the project is 5.4 billion yuan. After completion, the annual production capacity will be 12 million semi-steel tires, 2.4 million all-steel tires, and 60,000 engineering radial tires.

On April 15, 2020, Linglong's fifth production base in China, Jilin Linglong's 14.2 million tire intelligent production project was launched in Changchun.

On June 9, 2021, Linglong Tire announced that it decided to build the sixth domestic production base in Tongchuan, Shanxi Province, with an annual output of 15.2 million sets of high-performance radial tires and 500,000 sets of retreaded tires.

In June 2021, Linglong Tire adjusted its "6+6" strategy to "7+5" strategy (7 production bases in China and 5 production bases overseas).

On August 26, 2021, Linglong Tire's board of directors reviewed and approved the investment of 5.208 billion yuan to build the seventh domestic production base in Longqiao Chemical Park, Lujiang County, Hefei City, Anhui Province. Funds have been invested in the project with an annual output of 14.6 million sets of ultra-high performance self-healing and intelligent radial tires. So far, Linglong Tire's seven domestic production bases have all been unveiled.

(3)Zhongce Rubber

On February 12, 2020, the foundation stone was laid for the civil engineering of Zhongce Rubber's Phase III all-steel tire workshop in Thailand.

(4)Sailun Group

On February 21, 2020, the expansion project of Sailun Dongying Plant with an annual output of 27 million high-performance semi-steel tires was launched.

On May 25, 2020, the first tire of the 3 million semi-steel tire expansion project of Sailun Vietnam factory officially rolled off the production line.

On November 18, 2020, Sailun (Shenyang) Company's annual output of 3.3 million high-performance intelligent all-steel tires was put into production.

On January 9, 2021, Sailun Group announced that it will invest more than 3 billion yuan to build the third phase of the Sailun (Vietnam) project, with an annual production capacity of 3 million semi-steel tires , 1 million all-steel tires and 50,000 tons of off-road tires.

On May 31, 2021, the board of directors of Sailun Group agreed to invest an additional 1.1 billion yuan to increase the annual production capacity of semi-steel tires for the Cambodia project to 9 million.

On June 27, 2021, Sailun Weifang Tire Co., Ltd. put into production the annual production of 6 million high-performance semi-steel tires and 1.5 million all-steel tires.

(5)Jinyu Tire

On June 18, 2020, the foundation stone of Shandong Jinyu's annual production of 2 million all-steel tires was laid in Vietnam; on March 30, 2021, the first all-steel tire of Jinyu's Vietnam factory rolled off the production line.

(6)Guizhou Tire

On April 1, 2021, the first batch of tires of the Guizhou Tire Vietnam plant with an annual output of 1.2 million all-steel tires rolled off the production line, and the first phase of the project was completed.

On August 1, 2021, Guizhou Tire announced the new "Intelligent Manufacturing Project of High-Performance All-Steel Radial Tire with an Annual Output of 3 Million Sets".

(7)Prinx Chengshan

On March 25, 2020, the first all-steel tire of Prinx Chengshan plant in Thailand rolled off the production line; on April 18, the first semi-steel tire rolled off the production line. The project has an annual production capacity of 800,000 all-steel tires and 4 million semi-steel tires.

In June 2021, the 5 billion yuan project invested by Pulin Chengshan Anhui Company was put on record. The project site is located in Hefei Circular Economy Demonstration Park, with a designed annual production capacity of 2 million all-steel tires , 10 million semi-steel tires, 150,000 all-steel engineering radial tires and 2 million sets of air springs.

(8)Double Star Tires

In August 2021, Double Star Dongfeng Tire's "Industry 4.0 Intelligent Factory Project (Phase I) Project" was completed and passed the acceptance. The designed annual production capacity of the project is 1.5 million green all-steel tires and 5 million semi-steel tires; the first phase of the project has been completed with an annual output of 1 million all-steel tires and 5 million semi-steel tires.

III. Tire production in China

1. The tire sales revenue of the ranking companies in the past 6 years

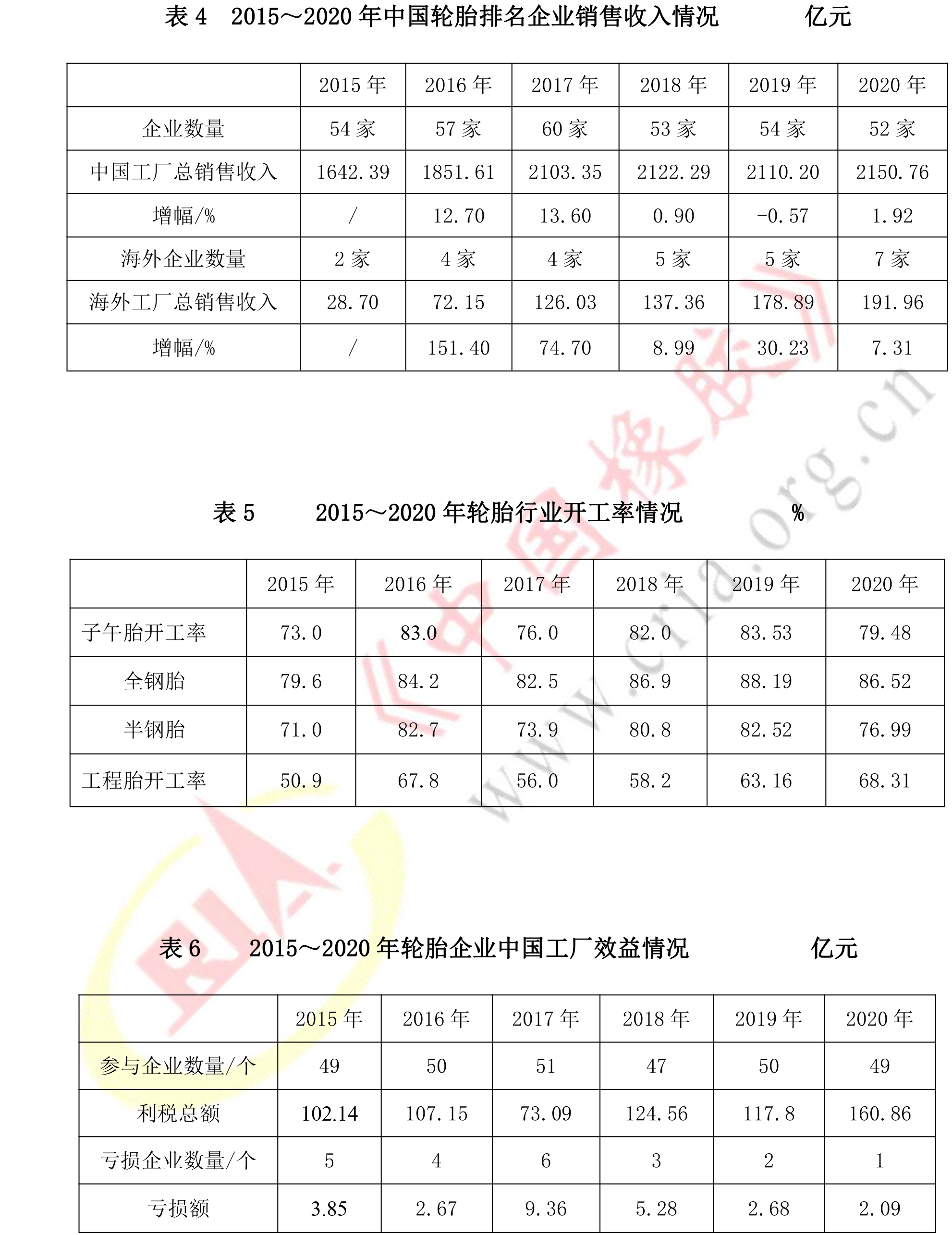

Among the 52 companies participating in the ranking of Chinese tire companies in 2021, 51 tire companies filled in the production capacity and output data.

It can be seen from Table 4 that in 2020, the domestic tire sales revenue of the statistical enterprises increased slightly by 1.92%, basically maintaining a stable operation. Affected by the outbreak of the epidemic at the beginning of the year, domestic tire production and sales in 2020 fell first and then increased. The first half of the year was greatly affected. The market improved in the second half, and sales continued to rise. Although exports were ups and downs, the situation at the end of the year was better than expected. In addition, the price of tire raw materials in 2020 is basically at a low level, and gradually increased in the fourth quarter, and the production cost is under control.

In the past six years, Chinese tire companies have accelerated their pace of going global, and in 2020, two more overseas companies will be added. In 2020, seven overseas factories of Zhongce Rubber, Linglong Tire, Qingdao Senturin, Sailun Group, Shuangqian Tire, Prinx Chengshan, and Jiangsu General Motors have formed production capacity. Guizhou Tire and Shandong Jinyu also initially formed production capacity this year. Next year, China The number of overseas tire companies will be added by two more.

2. Operating rate of tire industry

It can be seen from Table 5 that the operating rate of radial tires (including all-steel tires and semi-steel tires) of domestic enterprises in 2020 will decrease compared with the previous year, and the operating rate of engineering tires will continue to rise .

IV. Profit and tax of tire enterprises

From Table 6, it can be seen that the profit and tax of the tire industry in 2020 is significantly higher than that of the previous year, an increase of 36.55%. Although there are some changes in some companies, it still shows that the industry benefited better last year.

In 2020, despite the sudden outbreak of the coronavirus epidemic, due to the effective control of the epidemic in China, production was able to recover quickly, and the spread of foreign epidemics was not well controlled, leaving room for my country's tire exports, so the production capacity of tire enterprises was fully released, and tires throughout the year were fully released. Production and market conditions are generally improving, and the price of raw materials throughout the year is basically at a low level, so the tire industry has better benefits. In particular, the profit situation of leading companies is good, which is very obvious from the reports of listed tire companies. The China Rubber Association Tire Branch conducted statistics on 35 member companies. In 2020, industry profits will increase by about 39%. The profit margin of tire sales has increased from 2.92% in the first quarter to 6.84% in the fourth quarter. Among them, the leading enterprises have created a larger part of the profits. Corporate polarization has intensified.

In addition, overseas factories are significantly more profitable than domestic factories, bringing huge profits to enterprises going abroad.

In 2021, due to the sharp rise in the price of raw materials, the domestic demand replacement market consumption is generally not prosperous. Since the second quarter, some economic indicators have fallen sharply from the previous quarter, and the industry's profitability has fallen sharply. According to the statistics of the Tire Branch, 31 companies realized a profit increase of 24.08% in the first half of the year, and the profit margin of sales revenue was 3.71%, an increase of 0.09 percentage points; from January to July, the statistics of 33 companies realized a decrease of 4.82% in profit; the profit margin of sales revenue was 4.22%, a decrease of 0.94% percent.

Conclusion

First, the industry has structural overcapacity, but the investment in new projects is still rapid, and a large number of new state-owned and private capital have joined, which will inevitably accelerate industry integration, accelerate the pace of corporate mergers and acquisitions, widen the gap between brands, and concentrate resources on dominant companies, the advantages of leading companies are becoming more and more obvious;

Secondly, tire companies continue to accelerate the construction of overseas factories, and overseas factories are more profitable than domestic factories;

Third, tire companies must adhere to all-round innovation, focus on improving development quality and efficiency, build a new development pattern, form a dual cycle of domestic and foreign markets, and improve core competitiveness and achieve high-quality development;

Fourth safety, environmental protection, and energy saving are the foundation of an enterprise's survival and an important driving force for enterprise innovation;

Five is intelligence and industrial Internet will be more popularized in the tire industry.